80eea Deduction For Ay 202424

Blog80eea Deduction For Ay 2025-24. Benefits on repayment of principal amount (section 80c) 1. 1.5 lakh if they purchase an affordable property.

This is in addition to the rs 2 lakhs that the buyer already saves under. Tax deduction at source (tds) means collecting tax on income in the form of salary, rent, asset sales, dividends, etc., by requiring the payer to collect income tax due.

“a home loan can help avail an 80c deduction of up to ₹1.5 lakh, 80ee deduction of ₹50,000, and 24 (b) deduction of ₹2 lakh.

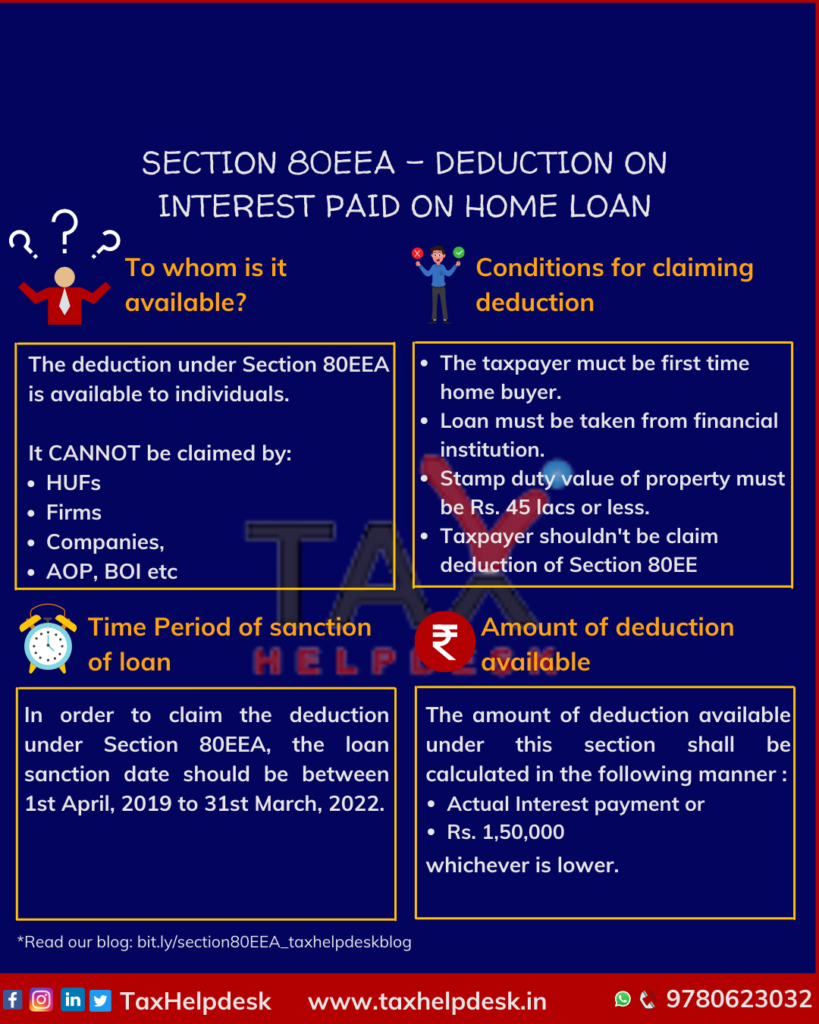

Section 80EEA Deduction on interest paid on home loan TaxHelpdesk, A complete guide on section 80ee of income tax act. Overall, the assessee is eligible to claim deduction of any interest payable on capital borrowed for acquisition and construction of house property upto maximum of.

All About Section 80EEA for Deduction on Home Loan Interest, Overall, the assessee is eligible to claim deduction of any interest payable on capital borrowed for acquisition and construction of house property upto maximum of. It's always advisable to refer to the official tax.

80EEA Deduction for Interest paid on home loan for affordable housing, Tax deduction at source (tds) means collecting tax on income in the form of salary, rent, asset sales, dividends, etc., by requiring the payer to collect income tax due. This is in addition to the rs 2 lakhs that the buyer already saves under.

A Comprehensive Guide to 80EEA Deduction Eligibility, Benefits, and, Hence a total taxable value. Eligibility and requisite conditions u/s 80ee:

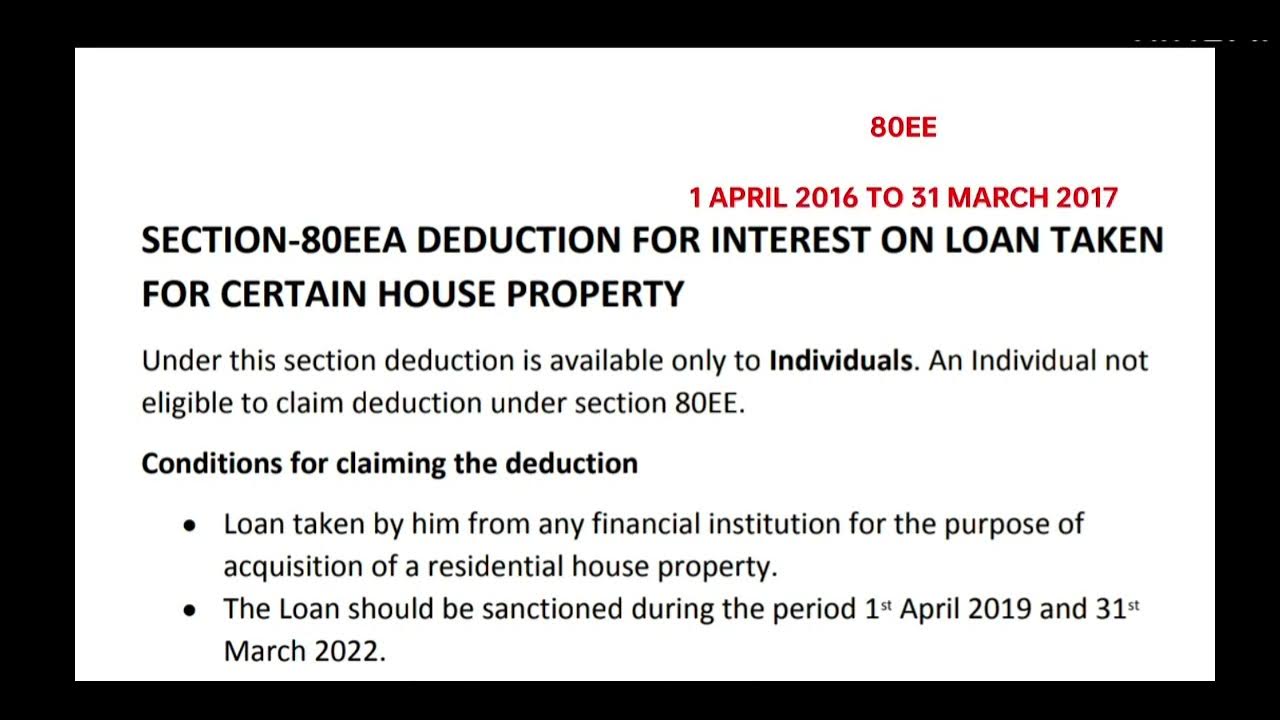

Section 80EEA of tax act Deduction 80eea New section, “a home loan can help avail an 80c deduction of up to ₹1.5 lakh, 80ee deduction of ₹50,000, and 24 (b) deduction of ₹2 lakh. This is in addition to the rs 2 lakhs that the buyer already saves under.

Live Fill Section 80EEA & 80EE in Tax Return Claim deduction, The section allows taxpayers to claim a deduction for the payment of interest on home. The deduction under section 80eea is calculated based on the interest paid on the home loan.

SECTION 80EEA ADDITIONAL BENEFIT ON HOME LOAN RBGCONSULTANTS , The maximum deduction allowed is up to rs. Section 80ee is a facility in the income tax act that provides relief for taxpayers who have obtained a home loan.

Deduction for interest on home loan (Sec 80EEA) FinancePost, It's always advisable to refer to the official tax. Tax deduction at source (tds) means collecting tax on income in the form of salary, rent, asset sales, dividends, etc., by requiring the payer to collect income tax due.

Sec 80E, Sec 80EE, Sec 80EEA (हिंदी मे ) Deduction for Loan Interest, Deduction is limited to whole of the amount paid or deposited subject to a. Benefits on repayment of principal amount (section 80c) 1.

Section 80EE Tax Deduction for Interest on Home Loan Tax2win, Repayment of principal amount on actual payment basis is allowed as deduction if all of the following conditions. The maximum deduction allowed is up to rs.

80eea deduction towards interest payments made on loan taken for acquisition of residential house property for the first time where the loan is sanctioned between 1st.